Overview

If you need a credit card that offers straightforward cash rewards, consider Citi Double Cash Card, issued by our partner Citibank. This credit card provides a $200 bonus cash back along with a consistent 2% cash back on all purchases. It allows you to earn an unlimited 1% cash back when making purchases, with an additional 1% cash back as you pay for those transactions. As of October 2024, it is running a special offer to give out 5% cash back on eligible travel purchases through 12/31/25. The card also features no annual fee and 0% introductory APR on balance transfers for the first 18 months.

Card Summary

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time.

Plus, a special travel offer, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/25. - Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 18.24% - 28.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

- Intro APR

- 0% on Balance Transfers

- Intro APR Period

- 18 months

- Annual Fee (rates & fees)

- $0

- Credit Needed

- Excellent, Good, Fair

Card Benefits

Special Offer: $200 Cash Back Bonus

Citi Double Cash Card users have the opportunity to earn a $200 cash rewards bonus by making $1,500 in purchases within the initial 6 months. Receiving this $200 cash rewards bonus translates to a 13% discount on the first $1,500 spent — an effortless means of increasing the cash back in your wallet.

Cash Back: How Citi Double Cash Works

By earning 1% cash back when making purchases and an additional 1% when paying off the balance, you accumulate a total of 2% cash back on all your expenditures. The cash back has no limits, and as long as your account remains open, your earned rewards don’t expire.

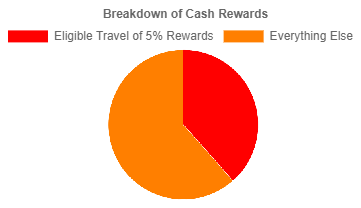

In addition, Citi Double Cash Card is running a special travel offer to let you earn 5% cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/25.

Illustratively, if your annual card spending amounts to $30,000, including $6,000 in eligible travel purchases of 5% cash back, you will receive $780 in cash back rewards. You can utilize our cash rewards calculator to determine the potential cash back rewards based on your specific expenditures.

| Spending Category | Spending | Cash Rewards | Net Spending (after Cash Back) |

|---|---|---|---|

| Eligible Travel Purchases of 5% Cash Back | $6,000.00 | $300.00 | $5,700.00 |

| Everything Else | $24,000.00 | $480.00 | $23,520.00 |

| Total | $30,000.00 | $780.00 | $29,220.00 |

0% Introductory APR

Additionally, it offers a 0% introductory APR on balance transfers, enabling you to transfer your current credit card balance and benefit from an extended period of 18 months with no interest. This provides an opportunity to save on interest costs. Post the introductory period, a go-to rate of 18.24% - 28.24% (variable) applies.

Fees

Citi Double Cash Card boasts a zero annual fee, allowing you to retain the card without incurring any charges. On the other hand, it has foreign transaction fees at 3% of each transaction in U.S. dollars. If you’re planning to use a credit card for international transactions, it’s crucial to be aware of any foreign transaction fees and consider other cards that may offer more favorable terms for overseas spending if that’s a significant part of your financial activity.

Required Credit Rating

Citi Double Cash Card is tailored for individuals with an excellent, good, or fair credit profile.

Bottom Line

To recap, here are the main pros and cons when considering Citi Double Cash Card:

Pros

Double Cash Back: Citi Double Cash Card provides a unique structure where you earn 1% cash back on all purchases when you make them and an additional 1% cash back when you pay them off. This effectively gives you 2% cash back on every purchase, making it competitive in the cash back rewards category.

Sign-Up Bonus: The card offers a sign-up bonus of $200 cash, which makes it quite attractive.

No Annual Fee: Citi Double Cash Card does not charge an annual fee, making it a cost-effective option for cardholders.

Simplicity: The card’s structure eliminates the need to navigate through different spending categories or deal with quarterly changes, offering a straightforward way to earn rewards on all purchases.

Acceptance: Citi Double Cash Card is a Mastercard, which is accepted at nearly every merchant that accepts credit cards, both in the US and internationally.

Balance Transfer Intro APR: The card typically offers a 0% introductory APR on balance transfers for a long period of 18 months, providing a potential benefit for those looking to transfer and manage existing credit card debt.

Cons

Foreign Transaction Fee: If you frequently travel internationally, it’s important to note that the card has foreign transaction fees, which may not be ideal for those who spend internationally.

Variable APR: The APR can be relatively high, especially if you have less-than-excellent credit, so it’s important to consider this if you carry a balance.

Is this the right card for you?

If you desire simple and direct cash back rewards without the burden of an annual fee, the Citi Double Cash Card is an obvious and advantageous choice. This card grants a $200 cash bonus following qualified spending and ensures a consistent 2% cash back on all purchases. Furthermore, it extends a 0% introductory APR on balance transfers for an extensive period of 18 months, providing a valuable opportunity to alleviate existing credit card debt.

Similar Rewards Credit Cards

If you are interested in the Citi Double Cash Card, it’s worth exploring a few other credit cards that offer comparable benefits.

2% Fixed Rate Cash Back Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| TD Double Up℠ Credit Card | $0 | |

No-Annual-Fee Rewards Credit Cards

| Credit Card | Bonus and Rewards | Annual Fee | |

|---|---|---|---|

| Chase Freedom Unlimited® | $0 rates & fees | |

| Blue Cash Everyday® Card from American Express | $0 rates & fees | |

| Costco Anywhere Visa® Card by Citi | $0 rates & fees | |

0% APR Balance Transfer Credit Cards

| Credit Card | 0% APR | Annual Fee | |

|---|---|---|---|

| Citi® Diamond Preferred® Card | 0% on purchases for 12 months and on qualifying balance transfers for 21 months. After the intro period ends, the go-to rate of 17.24% - 27.99% (variable) applies. (rates & fees) | $0 |