Credit Card Limited-Time Offers or Special Offers

The following credit card offers are limited-time or new special offers. Enjoy the rewards that are better than before. Hurry up! Limited-time or special offers usually do not last long.

| Credit Cards | Purchase APR | Transfer Info | Annual Fee | Credit Level |

|---|---|---|---|---|

| Back to top | ||||

| Ink Business Cash® Credit Card | 0% intro APR 17.49% - 25.49% Variable rates & fees | 17.49% - 25.49% Variable | $0 | Excellent, GoodApply NowView Card Details |

| ||||

| The Business Platinum Card® from American Express | 18.49% - 27.49% Variable APR rates & fees | N/A | $695 | Excellent, GoodApply NowView Card Details |

| ||||

| Hilton Honors American Express Card | 19.99% - 28.99% Variable APR rates & fees | N/A | $0 | Good To ExcellentApply NowView Card Details |

| ||||

| Aeroplan® Credit Card | 20.49% - 28.99% Variable rates & fees | 20.49% - 28.99% Variable | $95 | Excellent, GoodApply NowView Card Details |

| ||||

| Hilton Honors American Express Surpass® Card | 19.99% - 28.99% Variable APR rates & fees | N/A | $150 | Good To ExcellentApply NowView Card Details |

| ||||

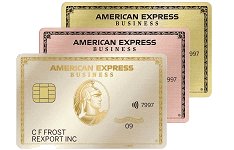

| American Express® Business Gold Card | 0% intro APR 18.49% - 27.49% Variable APR after that rates & fees | N/A | $375 | Excellent, GoodApply NowView Card Details |

| ||||

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- 0% introductory APR for 12 months on purchases

- Member FDIC

- Welcome Offer: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 10/2024. Access is limited to eligible Card Members.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card®. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card®.

- Fly like a pro with a $200 Airline Fee Credit. Select one qualifying airline to receive up to $200 back per year on baggage fees and other incidentals.

- NEW! Make the Business Platinum Card® work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required.

- Earn 5X Membership Rewards Points® on Flights, and Prepaid Hotels Booked through AmexTravel.com

- 1X points on other eligible purchases

- Earn 1.5X points (that's an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more, on up to $2 million per Card Account per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus.

- $199 CLEAR® Plus Credit: Use your card and get up to $199 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card®.

- $695 Annual Fee.

- Terms Apply.

- Earn 70,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $2,000 in purchases on the Hilton Honors American Express Card in your first 6 months of Card Membership. Offer Ends 4/29/2025.

- Earn 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with hotels and resorts within the Hilton portfolio.

- Earn 5X Points per dollar on purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 3X Points for all other eligible purchases on your Card.

- Enjoy complimentary Hilton Honors™ Silver status with your Card. Plus, spend $20,000 on eligible purchases on your Card in a calendar year and you can earn an upgrade to Hilton Honors™ Gold status through the end of the next calendar year.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- No Annual Fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Earn up to 70,000 bonus points

- Earn 60K bonus points after you spend $3,000 on purchases in the first 3 months your account is open. Earn 10K bonus points after your annual fee renewal payment posts and is paid in full

- $95 Annual Fee

- Redeem points for both international and domestic flights with the Aeroplan® Credit Card.

- Fly to another continent and travel the world with the Aeroplan® Credit Card.

- Earn 3X points for each dollar spent at grocery stores, on dining at restaurants, and Air Canada directly. Earn 1X point for each dollar spent on all other purchases.

- 500 bonus points for every $2,000 you spend in a calendar month - up to 1,500 points per month.

- Member FDIC

- Earn 130,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership. Offer Ends 4/29/2025.

- Get up to $50 in statement credits each quarter for purchases made directly with a property in the Hilton portfolio on your Hilton Honors American Express Surpass® Card. That's up to $200 in statement credits annually.

- Earn 12X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with a hotel or resort within the Hilton portfolio.

- Earn 6X Points for each dollar of purchases on your Card at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations.

- Earn 4X Points for each dollar on U.S. Online Retail Purchases.

- Earn 3X Points for all other eligible purchases on your Card.

- Earn a Free Night Reward from Hilton Honors after you spend $15,000 on eligible purchases on your Card in a calendar year.

- Enjoy complimentary Hilton Honors™ Gold Status with your Hilton Honors American Express Surpass® Card.

- Spend $40,000 on eligible purchases on your Card in a calendar year and you can earn Hilton Honors™ Diamond Status through the end of the next calendar year.

- As a Hilton Honors American Express Surpass® Card Member, you can enroll to receive complimentary National Car Rental® Emerald Club Executive® status through the link on your American Express online account. After you're enrolled, you can reserve a rental car by calling National Car Rental directly, using your travel service, or by booking online or through the National Car Rental mobile app. Terms apply.

- No Foreign Transaction Fees. Enjoy international travel without additional fees on purchases made abroad.

- $150 annual fee.

- Apply with confidence. Know if you're approved for a Card with no impact to your credit score. If you're approved and you choose to accept this Card, your credit score may be impacted.

- Terms Apply.

- Welcome Offer: Earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.*

- 0% Intro APR † for 6 months from the date of account opening on purchases eligible for Pay Over Time, then a 18.49% to 27.49% variable APR.*

- Earn 4X Membership Rewards® points on the top two eligible categories where your business spends the most each month from 6 eligible categories. While your top 2 categories may change, you will earn 4X points on the first $150,000 in combined purchases from these categories each calendar year (then 1X thereafter). Only the top 2 categories each billing cycle will count towards the $150,000 cap.*

- Earn 3X Membership Rewards® points on flights and prepaid hotels booked on amextravel.com using your Business Gold Card.*

- Earn up to $20 in statement credits monthly after you use the Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and Office Supply Stores. This can be an annual savings of up to $240. Enrollment required.*

- Get up to a $12.95** statement credit back each month after you pay for a monthly Walmart+ membership (subject to auto-renewal) with your Business Gold Card. *Up to $12.95 plus applicable taxes on one membership fee.

- The Business Gold Card comes in three metal designs: Gold, Rose Gold and White Gold. Make your selection when you apply on Americanexpress.com.

- *Terms Apply